WREZ Incentives

State Incentives Fueling Growth

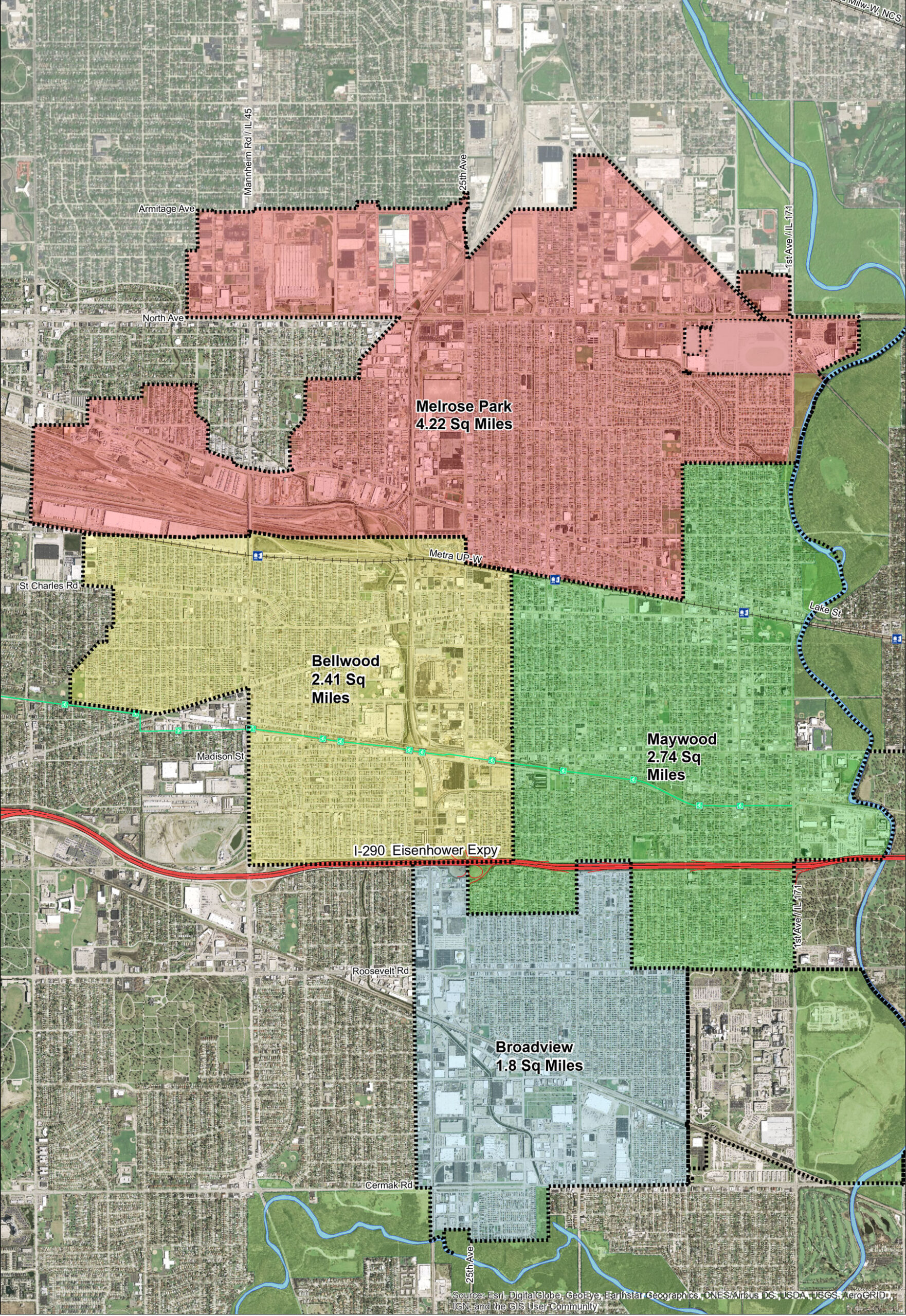

The WREZ is an area designated by the State of Illinois in cooperation with a local government to receive tax incentives and other benefits to stimulate economic activity. Our Program offers numerous state incentives to encourage companies to locate to or expand within the WREZ region, which includes, Bellwood, Broadview, Maywood, Melrose Park, and parts of Unincorporated Cook County. Below is a summary of the incentives offered. For more detailed information on each incentive, click here.

- Investment Tax Credit: The State of Illinois allows a .5% credit against state income taxes for investments in qualified property used in an enterprise zone.

- Jobs Tax Credit: Employers in an Enterprise Zone may obtain a $500 tax credit on their Illinois income taxes for hiring dislocated or economically disadvantaged individuals.

- Illinois Sales Tax Exemptions: 7.75- 10% Illinois sales tax exemption on building materials purchased from a WREZ business for use in real estate remodeling, rehabilitation, or new construction. Business materials do not have to be purchased in the Zone and can be purchased from an Out-of-State Manufacturer. Click here to see a detailed list of qualified materials.

- Machinery Or Pollution Control: A similar 6.25% state sales tax exemption is available on purchases of personal property used in the assembly or manufacturing process or in the operation of a pollution control facility within an enterprise zone. Eligibility for this exemption is contingent upon a business making a $5 million dollar investment which causes the creation of 200 full time equivalent jobs. A business must make an application to DCEO for this exemption.

- Utility Tax Exemption: A state utility tax exemption on gas, electricity and telecommunications is available to businesses located in enterprise zones.

Proudly serving the communities of Bellwood, Broadview, Maywood, Melrose Park and parts of Unincorporated Cook County.